Income for your employee while they recover

If your employee is injured and can’t work, we can help cover their lost income through weekly compensation.

Payments for the first week after injury

In the first week after their injury, your employee can get income in different ways:

- If their injury happened at work: As their employer you’ll pay 80% of their regular income for the first calendar week.

- If their injury happened outside of work: Your employee can ask to use their sick or annual leave to cover this time off.

Payments from week two after injury

Your employee can apply for weekly compensation once their claim is approved.

Weekly compensations covers up to 80% of your employee’s income. Your employee can ask to use their sick or annual leave to ‘top up’ their pay to bring earnings from 80% to 100% of usual income. This has no effect on their compensation from us.

Some employers choose to top up their employee’s income to their normal income from payroll, rather than their leave entitlements. Top-ups may be taxed as a secondary source of income. If your employee receives income from both you and us, ask them to check their tax code with Inland Revenue.

How employee payments work

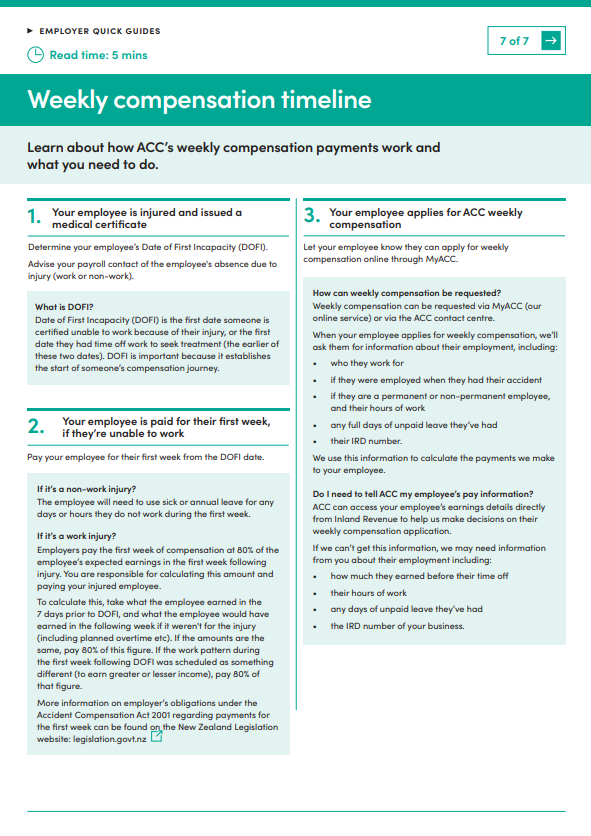

We’ve created a guide which outlines how our weekly compensation works and what you need to do.

Managing payments as they return to work

Your employee can return to work while they’re recovering, with reduced hours or alternative duties and still receive some weekly compensation.

As their employer, you need to pay them for the hours they work. We’ll adjust their weekly compensation payment, based on the income they receive from you. Their total income must not be more than 100% of their usual pay.

Your employee will need to tell us what they earn to prevent overpayment. They can do this through their MyACC account, or by calling us.

Phone 0800 101 996 (Monday to Friday, 8am - 6pm)

Weekly compensation stops when they’re back to their usual role

Keep connected with your employee to understand when they're ready to fully return to work. This may be based on medical clearance or their own recovery progress. Once a date is confirmed, make sure your payroll team knows.

Employers with a payroll team

If you have a payroll team please make sure they know about the injury and how many hours your employee is working, so they’re paid correctly.

If you have a complex payroll and many employees’ receiving weekly compensation, the Employer Reimbursement Agreement (ERA) may be able to help you pay them without interruption.

To find out if ERA is right for your business, email bep@acc.co.nz

Public holiday payments

You generally won’t have to pay an employee for a public holiday while they’re receiving weekly compensation, but there are some exceptions. Visit the Employment New Zealand website to find out more.

Contact us

You can contact the payments team or claims team:

Phone 0800 101 996 (Monday to Friday, 8am – 6pm)

Overseas +64 7 848 7400

Last published: 23 January 2026